Industry: Fitness

Key Highlights

$12

to acquire

42,000

ACH conversions

TLDR for Operators & Business Owners

- Problem: Card fees and card failures were eating margin and inflating churn.

- Complicating factors: Stripe’s U.S. pricing lists ACH 0.8% (capped at $5) vs. cards at 2.9% + $0.30 — a gap that compounds at scale.

- Play: Offer a $20 branded digital gift card to members who switch their recurring dues from credit card to ACH.

- Outcome: 42,000 members switched to ACH at roughly $12 acquisition cost each; saving Retro Fitness approximately $34,700/month.

- Why it works: 1) ACH costs dramatically less than cards and fails less often. 2) rewards motivate action without training customers to expect discounts.

Chapters

- Retro Fitness’ Big Challenge

- The Intervention: A Reward, Not Discount

- Results of Retro Fitness’ ACH Conversion Campaign with Promotion Vault

- The Playbook Retro Fitness Used (& How To Copy It)

- What Made the Retro Fitness ACH Reward Program Work Well

- Bottom Line for Business Owners

- Frequently Asked Questions About ACH Conversions

Retro Fitness’ Big Challenge

Retro Fitness is a national HVLP (high-value, low-price) gym brand with over 120 operating locations (and many more in development), offering plans from $19.99–$29.99 per month — depending on your location.

Like most subscription businesses, the brand’s default tender skews toward credit/debit cards. That’s expensive and fragile: cards expire, are reissued after breaches, and get declined, producing involuntary churn that has nothing to do with customer intent. Stripe shows a common credit card transfer fee rate of 2.9% + $0.30. Its same page lists ACH Direct Debit at 0.8% with a $5 cap — clearly illustrating why moving recurring dues to ACH is a structural margin win.

Industry research ties a large share of subscription churn to failed payments and expired cards; Stripe notes a 2023 study attributing 50% of subscriber churn to failed payments, with expired cards being a contributor. Bank-to-bank methods like ACH materially cut failure rates versus cards, which is why many subscription operators like to rebalance their payment mix toward ACH.

Retro Fitness being one such operator. But it was stuck on how to get members to actually convert.

The Intervention: A Reward, Not Discount

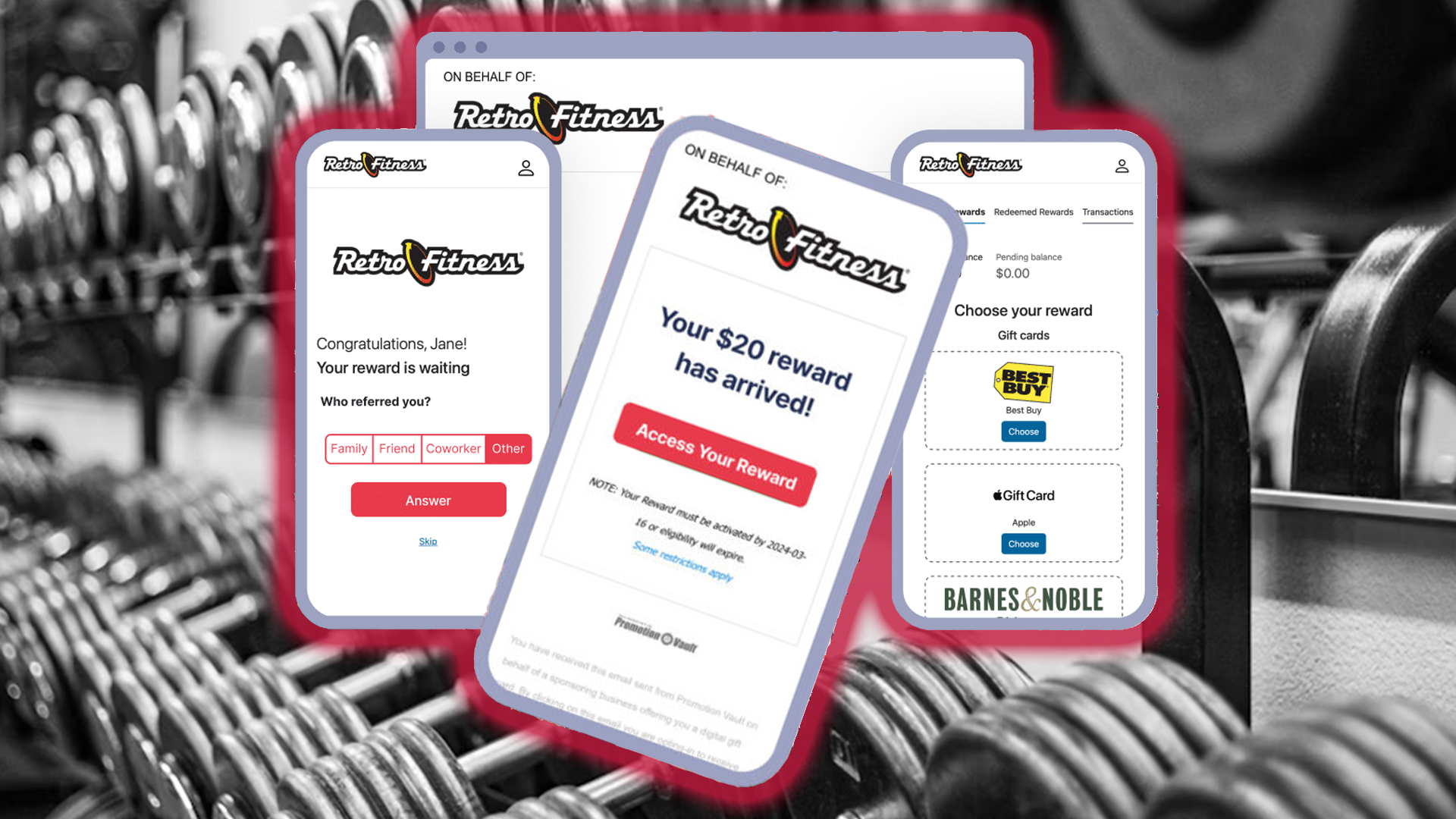

Retro Fitness deployed Promotion Vault’s rewards platform to nudge members into switching their billing method to ACH. The offer was simple: switch to ACH, receive a $20 branded digital gift card (member’s choice among major retailers). That reward is tender-neutral — it preserves the gym’s price integrity while motivating the specific behavior change the business needs.

And since Promotion Vault’s model ensures their customers only pay when a reward is activated, it was a very low-risk, high-reward opportunity for Retro Fitness — avoiding waste on unclaimed incentives and keeping CAC tight.

Results of Retro Fitness’ ACH Conversion Campaign with Promotion Vault

42,000 members switched to ACH at a one-time acquisition cost of ~$12 each. With $25 average dues, ongoing savings are about $34,700 per month. The one-time cost is recovered in roughly 14.5 months; after that, savings continue at roughly $34.7K per month.

Fee math (using Stripe’s illustrative U.S. rates)

- Card on $25 dues: 2.9% × $25 + $0.30 = $1.025 (realistically $1.03)

- ACH on $25 dues: 0.8% × $25 = $0.20

- Per-member delta: $1.03 − $0.20 = $0.83 saved per month (exact: $0.825)

At 42,000 conversions

- Gross monthly savings: $0.825 × 42,000 = $34,650/mo (≈ $34.7K/mo)

One-time acquisition cost

- Acquisition cost: $12 × 42,000 = $504,000 (one-time)

- Month 1 net: $34,650 − $504,000 = −$469,350 (a net cost in month 1)

- Payback period: $504,000 ÷ $34,650 ≈ 14.5 months

- After payback: ≈ $34.7K/mo ongoing gross processing-fee savings

Payback Period & Ongoing Savings

Industry benchmarks show 12–24 months is standard when it comes to payback periods. Since payment processing fees are fixed ongoing costs, reducing them compounds value. After ~14.5 months, every additional month is nearly pure margin.

- Ongoing savings: ≈ $34.7K/month.

- Cumulative 3-year savings: ≈ $1.25M.

- That’s more than 2.5× the initial $504K investment, meaning long-term ROI is strong

The Ultimate Verdict on Using Promotion Vault for ACH Conversions

For gyms and other subscription businesses, a 14.5-month break-even on an ACH conversion campaign is actually ahead of the curve for most subscription-based business models, especially since it’s based purely on recurring fee savings rather than just customer-acquisition revenue. From an industry standpoint, it’s a strong and defensible ROI.

The Playbook Retro Fitness Used (& How To Copy It)

Converting members from cards to ACH isn’t about blasting discounts — it’s about shaping behavior with smart triggers, meaningful rewards, and a frictionless experience. Follow these six steps to design a high-conversion ACH switch campaign that protects margins and drives lasting savings.

1) Pick the behavior and the trigger.

Target billing-profile updates. Prompt members when they log into the portal, open billing emails, or hit a “past-due” friction point.

2) Put a clear reward on it — never a discount.

“Switch to ACH today—get a $20 digital gift card.” Reward value should be meaningful but not margin-destroying. Gift cards preserve your list price and avoid reference-price damage.

3) Make redemption brain-dead simple.

Use a digital reward flow (QR code, one-click email). Promotion Vault’s flow activates a member’s “rewards vault” in seconds; gyms only pay on activation.

4) Reduce friction in the ACH experience.

ACH setup UX matters; the cost advantage is wasted if enrollment is clunky. Learn how to optimize your autopay process.

5) Automate follow-ups.

If a member starts the switch and abandons, trigger a simple nudge: “Finish ACH setup and claim your reward.”

6) Measure the right things.

Track switch rate, cost per conversion, processing-fee delta, payment-failure rate, and 90-day retention of the switch cohort.

What Made the Retro Fitness ACH Reward Program Work Well

- A hard cost gap (ACH vs card) gave the incentive an economic “spine.”

- Involuntary churn risk from cards created an LTV upside in addition to fee savings.

- Reward mechanics (pay-on-activation) kept CAC lean and waste low.

- Brand integrity was protected — no long-term price anchoring from discounts.

Bottom Line for Business Owners

If processing fees and silent churn are taxing your P&L, don’t discount your product — reward the behavior that improves your margins. Retro Fitness’ results show how a simple, branded gift card incentive — paired with a pay-on-activation rewards platform and a clean ACH enrollment flow — can move tens of thousands of customers to a cheaper, stickier rail and return meaningful monthly savings.

Frequently Asked Questions About ACH Conversions

Is ACH really that much cheaper than cards?

In U.S. public pricing, yes: Stripe shows cards at 2.9% + $0.30 online vs ACH Direct Debit at 0.8% with a $5 cap. Savings magnitude depends on dues and processor, but this is generally true everywhere.

Will switching to ACH hurt conversion or retention?

Operators worry ACH adds friction, but that’s solvable with instant bank verification and smart UX. The upside — fewer expirations/declines — translates into lower involuntary churn and higher LTV.

Why not just offer 10% off dues to get the switch?

Because discounts retrain customers on price and can erode brand equity. Rewards drive behavior without moving the reference price.

Is ACH safe and “modern” enough?

ACH is the U.S. bank-to-bank rail that powers payroll, bill pay, and B2B. Same Day ACH volume grew 45.3% YoY in 2024 to 1.2B payments, underscoring mainstream adoption.

Over 4,700 Trusted Partners

See who else is creating exceptional experiences with Promotion Vault.